What Is a Personal Financial Statement?

Oct 19, 2024 By Kelly Walker

If managing your finances is intimidating and daunting, understanding a personal financial statement can help. It provides the specific details of your total income and assets, expenses and liabilities to determine where you stand financially at any given time.

Whether personally reviewing or providing it to a lender for review, understanding what comprises this document will offer great insight into your overall fiscal health. Check out this guide to find out more about what a personal financial statement consists of!

What is a Personal Financial Statement, and why do you need one

A Personal Financial Statement is an important document that can help you keep track of your financial standing. It includes a comprehensive overview of all your assets and liabilities, as well as your current income and expenses. With this information, you or someone else can make better decisions about managing and investing money.

Having a personal financial statement is useful for a variety of reasons. It can provide insight into your financial health and help you prioritize saving, spending, and investing. Additionally, it can be used when applying for loans or lines of credit to demonstrate the ability to pay – the lenders will likely request a copy of your financial statement before approving.

Understanding Your Assets and Liabilities

A personal financial statement is a document that outlines an individual's financial position at any given time. It includes information about income, expenses, assets, and liabilities. Assets are items or resources owned by an individual with a monetary value.

Examples include cash accounts (savings, checking, etc.), property like real estate, investments such as stocks and bonds, and other items that can be converted into cash. Liabilities are the money an individual owes for loans, credit cards, mortgages, etc.

By analyzing these different components of your financial statement, you can better understand your overall financial situation and make more informed decisions about the present and future. For example, if your liabilities (debts) exceed your assets, you may need to prioritize debt repayment before making other purchases or investments.

Alternatively, having a strong net worth (assets minus liabilities) could indicate the ability to save and invest more money.

Having an up-to-date personal financial statement is important to make sound financial decisions and plan for the future. It can also help you set realistic goals and create a budget that best suits your circumstances.

How to Prepare Your Financial Statement

A personal financial statement allows individuals to assess their financial health by documenting their assets, liabilities, and net worth. Preparing a personal financial statement involves gathering your most recent information on assets, such as bank accounts and investments, debts, income, and expenses. This information can be recorded in a spreadsheet or an online template to create a comprehensive financial statement.

Once you have gathered all the information, you can calculate your net worth by subtracting liabilities from assets. Your net worth indicates your overall financial health and should be monitored regularly to ensure it remains positive. A positive net worth means that your total assets are greater than your total liabilities and will provide you with the financial stability to achieve your long-term goals.

In addition to your financial statement, reviewing other documents such as insurance policies, wills and estate plans, tax returns, and monthly budgeting statements is important.

Tips for Keeping Your Financial Statement Accurate

1. Review your financial records regularly. Reviewing your financial documents and statements regularly to ensure accuracy is important. This can help you identify any discrepancies or errors that may have occurred before they become too serious.

2. Update information when necessary. If there are any changes in your income, debts, savings, investments, or other financial matters, update your financial statement as soon as possible to keep it accurate.

3. Use a reliable software system. Many excellent accounting and budgeting software programs are available that allow you to easily track and manage your finances. Using one of these programs can help ensure accuracy, and accuracy can help you keep your financial statement accurate.

4. Seek the advice of a professional accountant or financial advisor when needed. Suppose you need assistance understanding and interpreting your financial statements. In that case, it is always best to seek the counsel of a qualified professional who can provide guidance and advice regarding your finances. This can also help keep your financial statement accurate and up-to-date.

Understanding the Role of Specialists in Preparing a Personal Financial Statement

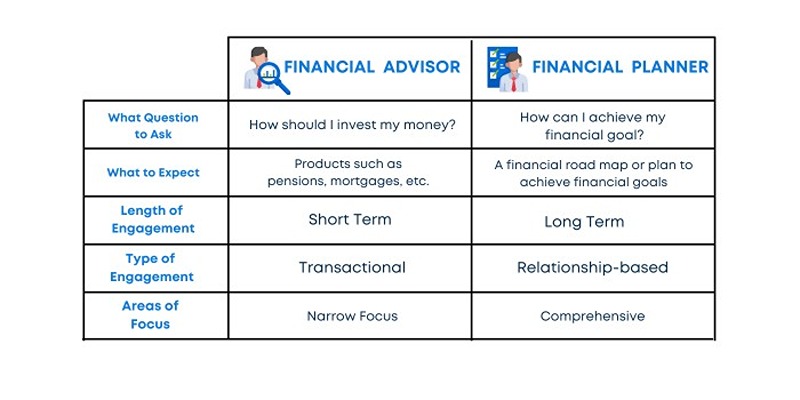

Financial professionals, such as accountants or Certified Financial Planners (CFPs), can help compile and analyze a personal financial statement. Their services can be invaluable in providing tailored advice on how best to manage your finances and guidance when making decisions about investments.

Additionally, they may be able to help identify any potential discrepancies in the figures, which could lead to errors or misstatements in the final financial report. It's important to note that individuals should always seek professional advice before making any changes to their persfinances; a personal financial statement is no exception.

A qualified professional will be able to provide you with up-to-date advice on the best way to manage your finances and help you make informed decisions about any investment opportunities. They will also be able to identify potential risks or areas of weakness in your financial position and suggest strategies for reducing these.

Key Benefits of Having an Up-to-date Personal Financial Statement

Having an up-to-date personal financial statement can provide several key benefits. A personal financial statement will allow you to track your progress, better understand your current financial situation, and make more informed decisions about managing your money.

When creating a personal financial statement, it's important to include accurate information about your assets, liabilities, income, and expenses. This information can calculate your current net worth - the difference between what you own (assets) and owe (liabilities).

A personal financial statement will also provide a snapshot of your cash flow, which is the monthly money coming in and out of your accounts.

FAQs

How often should I update my financial statement?

You should review and update your financial statement regularly, preferably once or twice a year. This will ensure that the information is up-to-date and accurate. Additionally, updating your financial statement can help you identify areas where you need to improve your financial situation.

What information do I need to provide when completing my financial statement?

You should include your income, expenses, assets, liabilities, and net worth on your financial statement. Additionally, you should list any debts or sources of income that have not been included in the form. Lastly, it is important to note any changes in your circumstances since the last time you completed the statement, such as a new job or a large purchase.

What is the purpose of creating a personal financial statement?

Completing a personal financial statement is to understand your current financial position. By regularly reviewing your income, expenses, assets, liabilities, and net worth, you can identify areas where you may need to improve your financial situation. Additionally, it can help provide clarity in making large financial decisions.

Conclusion

I hope this article has helped you to understand the importance of creating a personal financial statement. A personal financial statement provides an overview of your financial health and allows you to make informed financial decisions.

It is important to review your financial statement regularly to make sure that it accurately reflects your current financial situation. By understanding what a personal financial statement is and how to create one, you can be sure you are in control of your financial future.

What Is a Personal Financial Statement?

Get to know Does a Lost or Stolen Credit Card Hurt Your Credit Score

Best Age to Get Life Insurance

Reviewing the Air France KLM World Elite Mastercard

10 Biggest Mining Companies

Capital One Quicksilver Credit Card Review

Can’t afford to pay your taxes? Here are your options

Discovering the Secrets of Apple's Most Profitable Lines of Business

Understanding the Drivers Behind Real Estate Market Fluctuations