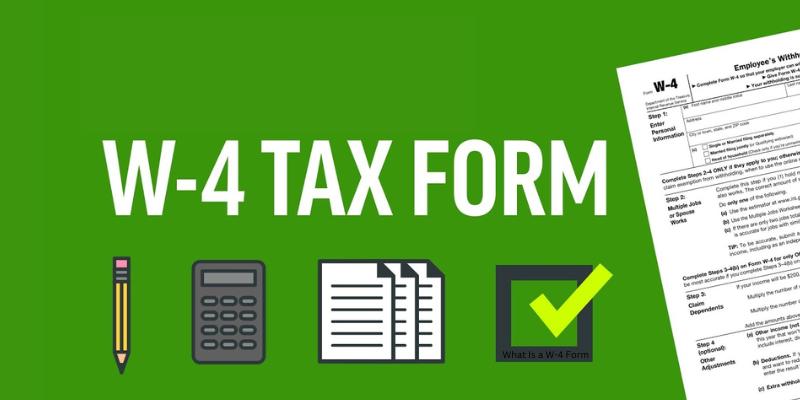

What Is a W-4 Form?

Dec 30, 2024 By Rick Novak

Do you know what a W-4 form is? It's the document you will likely fill out when you start a new job, but it can often be confusing. This important paperwork provides essential information for employers to determine how much money must be withheld from your paycheck for federal and state taxes.

Understanding what the W-4 Form is and how it works will help ensure that you have enough withheld throughout the year for your taxes and that any eligible credits or deductions don't go unnoticed. In this blog post, I'll explain exactly what a W-4 form is, why it's necessary, and much more.

What is a W-4 form, and why do I need one

A W-4 form is a document that is completed by employees for employers to help determine how much income tax should be withheld from an employee’s paycheck. This Form informs the employer about your financial situation, such as filing status, number of dependents, and any additional deductions or credits you may claim.

The employer will use this information to calculate the taxes it should withhold from each paycheck. You must fill out your W-4 form accurately, as the withholding amounts are based on this information. Fill out the Form correctly to avoid too much or too little tax being withheld, which could lead to penalties and interest charges at tax time.

By providing accurate information to your employer, you can ensure that the correct amount of taxes is taken out of your paycheck throughout the year, and you won’t owe a large sum when filing your taxes. Reviewing and updating the W-4 form annually or when your tax situation changes, such as marriage, divorce, or childbirth, is important. This Form also allows you to adjust your withholding for other deductions or credits you may qualify for.

How to complete the W-4 form step-by-step

The W-4 Form is the Form employers ask employees to fill out to figure out how much money to withhold from the employee's paycheck for taxes. Completing this Form correctly is important, as it ensures you're paying the appropriate taxes throughout the year. Here are the steps for filling out a W-4 form:

1. Enter your personal information, including name, address, and Social Security number. You will also need to enter the date you started your job.

2. Choose whether or not you would like to itemize your deductions or claim a standard tax deduction.

3. If you are married, choose."Married" or "Single." If you are married but file taxes separately, enter “Married, but withhold at the higher single rate.”

4. Check the box if you want additional money withheld from your paycheck for tax purposes. This is a good idea if you expect to owe taxes on Tax Day.

5. Enter any allowances that you are eligible for, such as dependents and childcare expenses.

6. Sign and date the Form to confirm your information is accurate.

7. Submit the Form to your employer.

By following these steps, you can easily complete a W-4 form so that the right amount of money is withheld from your paycheck for taxes. This will help you better handle your finances throughout the year and even avoid surprises when filing your taxes is time.

What information do I need to provide on the W-4 Form?

The information you must provide on the W-4 form includes your name, address, and Social Security number. You will also be asked to enter the total number of allowances you claim, which typically depend on your income level and filing status. Other information, such as additional withholding amounts, deductions, or credits, may also be required. Once you've filled out the Form, your employer will use it to withhold the appropriate taxes from your paycheck each period. Your W-4 information must be accurate and up-to-date to ensure you are paying the appropriate amount in taxes.

It is also important to understand that your filing status or income changes can affect your withholding amounts. As a result, it is important to review and update your W-4 information as necessary. You can make changes by submitting a new W-4 to your employer. Your employer will use the most recent form version to calculate how much should be withheld from each paycheck.

When completing your W-4 Form, it is important to keep in mind that the information you provide will determine how much tax you pay. Suppose you have any questions or concerns while completing the Form. In that case, it can be helpful to consult a tax professional who can answer your questions and help ensure you enter the correct information on your W-4.

When should I submit a new or updated W-4 Form?

Employees should fill out and submit a new W-4 Form each year or when their filing status changes. Generally, employers will ask employees to complete their Forms at the beginning of each new tax year if they still need to. Employees should also ensure that the information on their previous W-4 Form is still accurate; if necessary, they should update it as soon as possible.

Employers must keep a copy of an employee’s W-4 Form on file for three years after it was last updated. Employees can change their withholding information anytime during the year if circumstances change. It's always a good idea for employees to double-check their withholding information to ensure the right amount is being withheld from each paycheck.

By completing a W-4 Form, employees optimize how much tax money they can have withheld for the year and how much hard-earned money they take home in each paycheck. It's also important for employees to understand that the more allowances they claim, the less taxes are withheld from each paycheck. Employees should ensure they have enough withheld to cover their tax bill at the end of the year.

FAQs

What is the meaning of a W-4 form?

The W-4 Form is a document you submit to your employer when you begin a new job. It provides information about your personal and tax situation so your employer can withhold the correct amount of federal income tax from your paycheck. This helps to ensure that you're paying taxes appropriately throughout the year, leading to any surprises or penalties when filing your tax return.

What information do I need to provide on the W-4 Form?

You'll need to provide basic personal information, such as your name, Social Security number, address, and marital status. You also may need to specify deductions and credits that may affect your taxes, such as student loan interest or adoption expenses. Additionally, you may need to provide other withholding information if you expect a large refund or owe money come April.

Common mistakes to avoid when filling out the W-4 Form

When completing the W-4 form, it's important to be as accurate and honest as possible. If you make any mistakes or provide inaccurate information, your taxes may not be calculated correctly. Double-check all the information you provide and complete the Form completely and accurately.

Conclusion

Completing the W-4 Form can seem intimidating, but it doesn't have to be. This information on what a W-4 is, what information to enter, when to update it, and mistakes to avoid is much simpler than initially thought. It's important to remember that your employer uses this Form as a record of the taxes they need to collect from you. That being said, completing the Form accurately and promptly is essential for you and your employer.

How to Become a Venture Capital Associate

Capital One Quicksilver Credit Card Review

The Five Cs of Credit

Discovering the Secrets of Apple's Most Profitable Lines of Business

How to Maximize Your 401(k) Savings Based on Your Age?

Transferring IRA Money to an HSA

Demystifying Financial Structure: An In-Depth Overview

How to Setup an IRS Payment Plan

What Is a W-4 Form?